The Insurance Fraud Bureau (IFB) is an Insurance Council of New Zealand initiative to detect and deter general insurance fraud in New Zealand. The IFB has a mandate to educate the New Zealand public about insurance fraud, and part of this programme of work is to undertake annual research to assess how much Kiwis know and understand about insurance fraud. The results confirm for the second year running that a large number of Kiwis don’t understand the serious implications of insurance fraud and the potential impact that committing insurance fraud can have on all insurance policyholders.

There were a number of key findings (see our handy infographic for more details).

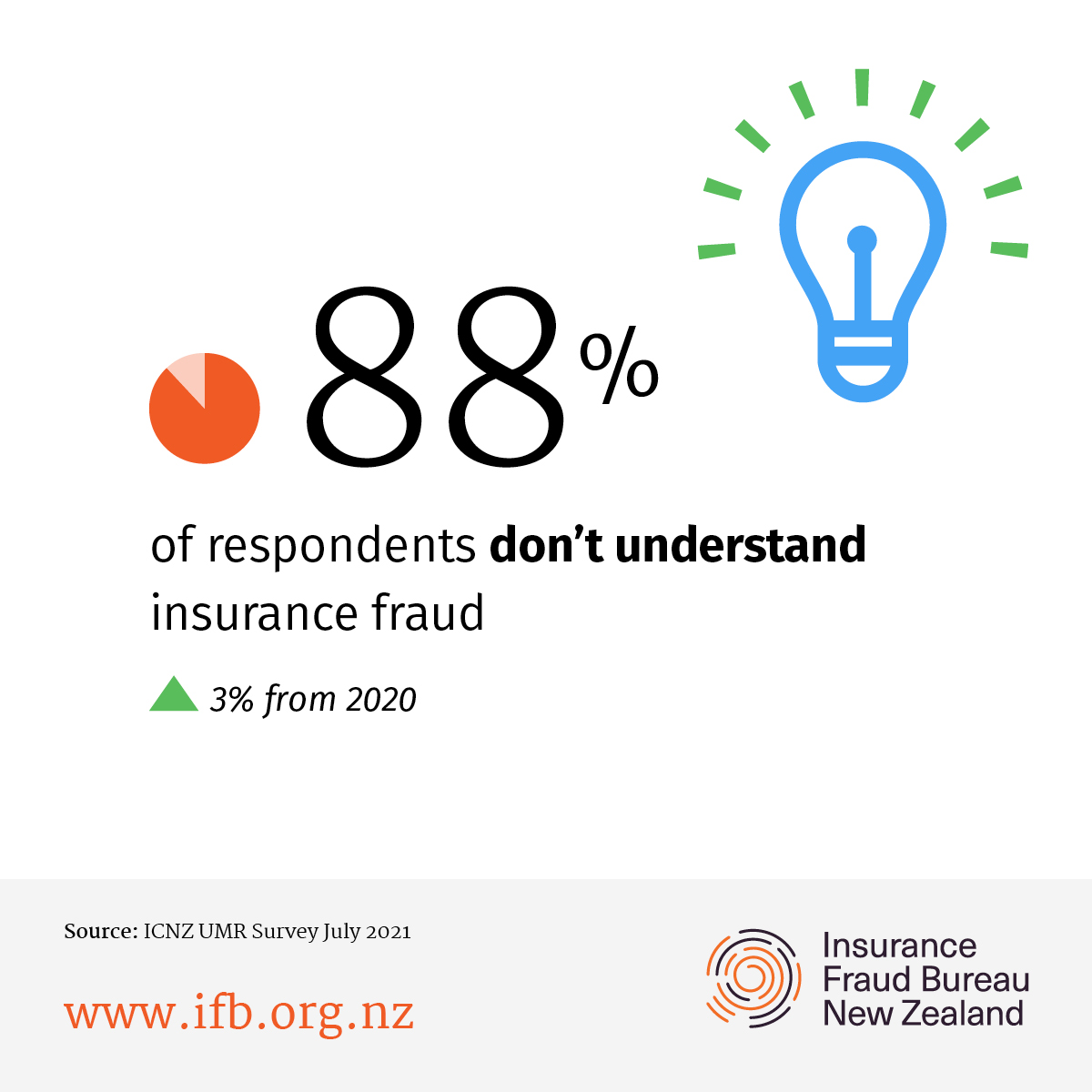

Importantly, 88% of respondents don’t understand insurance fraud. This figure is concerning but it is in fact a 3% improvement on our 2020 survey. It’s no surprise then, that six out of ten respondents don’t understand the consequences of committing insurance fraud.

What are the consequences of committing insurance fraud?

Declined claims? Jail time? Fines? The majority of Kiwis still don’t realise that insurance fraud is a criminal offence and you can be convicted if caught. Only two out of 10 respondents knew that having a claim declined is not the only action an insurer could take if you committed fraud. Similarly, only a little over half of respondents (57%) knew they could receive a criminal conviction if they were caught committing insurance fraud.

Who is likely to commit insurance fraud?

This year’s findings showed strong support for the belief that individuals were more likely than businesses to commit insurance fraud. 51% of respondents believed individuals were more likely to commit fraud which was a 9% increase on last year. It is encouraging to see people realise that anyone can commit fraud.

What types of insurance fraud are the most common?

63% of respondents thought that exaggerating claims was the most common type of fraud. This was up 7% from 2020 findings. 54% of respondents thought non-disclosure or misrepresentation of information was the second most common type of fraud (up 5% from last year).

“While the figures are still concerning, it is pleasing to see small improvements being made by our focused education efforts,”

Yvonne Wynyard, IFB Manager.

Knowledge of insurance fraud is another key survey metric

We wanted to dive into demographic groupings to better understand the types of people that have a good understanding of insurance fraud. Interestingly all demographic groups showed an increase in understanding from last year, the most significant shift being businesses with an 11% increase in their fraud knowledge. It is not surprising to see businesses better understanding insurance fraud. There has been a significant rise in cyber and phishing crime following the Covid-19 outbreak in 2020, and successive lockdowns across the world.

Males continue to have a better knowledge of insurance fraud than females (17% versus 7%). In terms of the knowledge in urban versus rural areas, rural areas have a better knowledge of insurance fraud compared to their urban counterparts (20% versus 11%).

To understand more about Kiwis’ knowledge of insurance fraud, take a look at our one page infographic for details.

What is the impact of insurance fraud?

It’s encouraging to see that 46% of respondents are concerned about the impact of insurance fraud (up 3% from 2020). 69% of respondents agree that insurance fraud led to higher premiums, while seven out of ten respondents felt fraud would lead to longer approval times for genuine insurance claims.

What is the cost of insurance fraud?

Unfortunately, the estimated cost of insurance fraud for all policyholders continues to be underestimated. Six out of ten respondents believe that New Zealand insurance fraud costs are only $70 million each year. However, our industry estimates the true cost to be $739 million.

“The sad reality of insurance fraud is that it is a cost that is covered by all policyholders. Improving this understanding will continue to be a key focus for IFB in our educational programme for the year ahead.”

Yvonne Wynyard, IFB Manager.

The IFB will continue their work to educate Kiwis about the implications of insurance fraud, and its impact on all policyholders. Surveys such as this one help to guide our work and ultimately deter fraudulent insurance activity in New Zealand.