Insurance fraud remains a pressing issue in New Zealand, affecting not only insurers but all policyholders through higher premiums. The results of our November fraud survey are in. The survey highlights the types of fraud, its perceived prevalence, and its consequences for both consumers and perpetrators. Here, we delve into the key findings from the November 2024 Fraud Survey to better understand how kiwis perceive insurance fraud. Let’s take a look

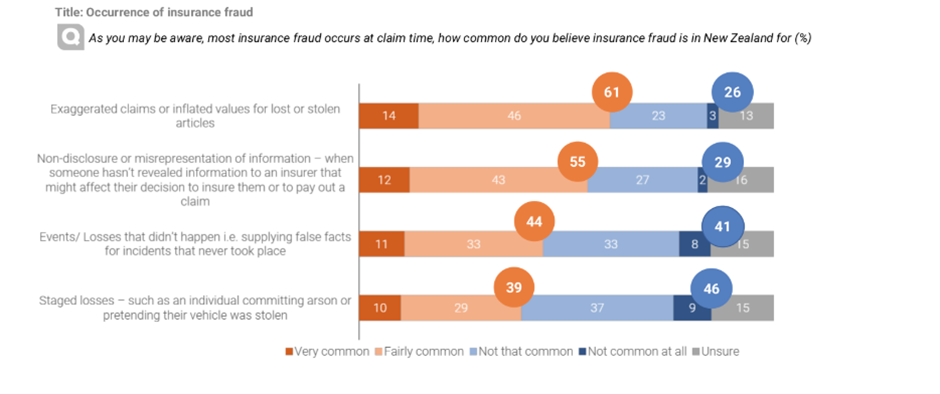

Survey respondents were asked “As you may be aware, most insurance fraud occurs at claim time, how common do you believe insurance fraud is in New Zealand for (%).”

The responses highlighted a strong awareness of exaggerated claims and misrepresentation of information. Indicating that 61% of respondents believe inflated claims for lost or stolen items are common, while 55% recognise the frequency of non-disclosure or misinformation impacting insurance payouts. Fraud involving entirely false events is seen as slightly less frequent, with 44% perceiving it as common, and staged losses, such as arson or fake thefts, being the least recognised at 39%. This data underscores the public’s concern about fraudulent behavior that inflates costs for honest policyholders and emphasises the need for vigilance in detecting and reporting fraud.

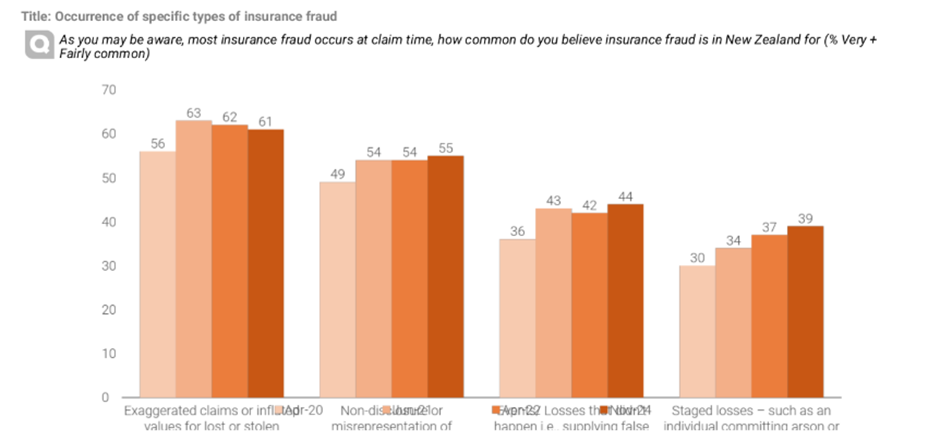

The historical data highlights how perceptions of insurance fraud in New Zealand have remained relatively consistent in recent years, with a slight upward trend in certain areas.

Exaggerated claims for lost or stolen items continue to be seen as the most common type of fraud, with 61% of respondents in November 2024 believing it occurs frequently—only a minor change from previous years. Similarly, non-disclosure or misrepresentation of information has remained stable at 55%. Fraud involving entirely false events has seen a small rise to 44%, while staged losses, such as arson or fabricated thefts, have shown the most notable increase, climbing from 30% in April 2020 to 39% in November 2024. This gradual rise suggests growing awareness of staged fraud, reinforcing the need for continued education and vigilance to protect honest policyholders from the financial burden of fraudulent claims.

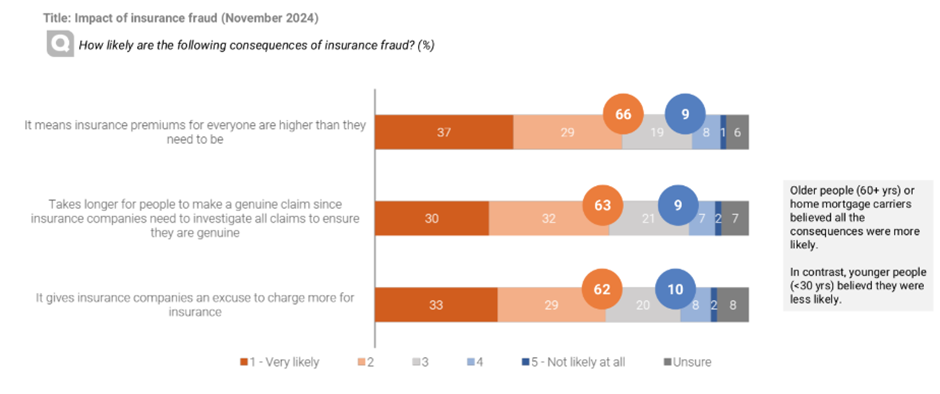

Respondents were asked “How likely are the following consequences of insurance fraud? Higher insurance premiums, longer to make genuine claims, an excuse to charge more for insurance?

Their responses highlight the significant negative impact insurance fraud has on consumers, with the most widely recognised consequence being higher insurance premiums. A striking 66% of respondents believe fraud directly leads to increased costs for all policyholders, reinforcing the financial burden it places on honest individuals. Additionally, 63% acknowledge that fraud results in longer claim processing times, as insurers must thoroughly investigate claims to verify legitimacy. Meanwhile, 62% perceive fraud as giving insurance companies a reason to raise prices. The survey also reveals a generational divide, with older respondents (60+ years) and mortgage holders more likely to recognise these consequences, while younger people (<30 years) were less convinced. These findings emphasise the widespread awareness of fraud’s impact and the need for continued efforts to combat dishonest claims to protect fair insurance pricing.

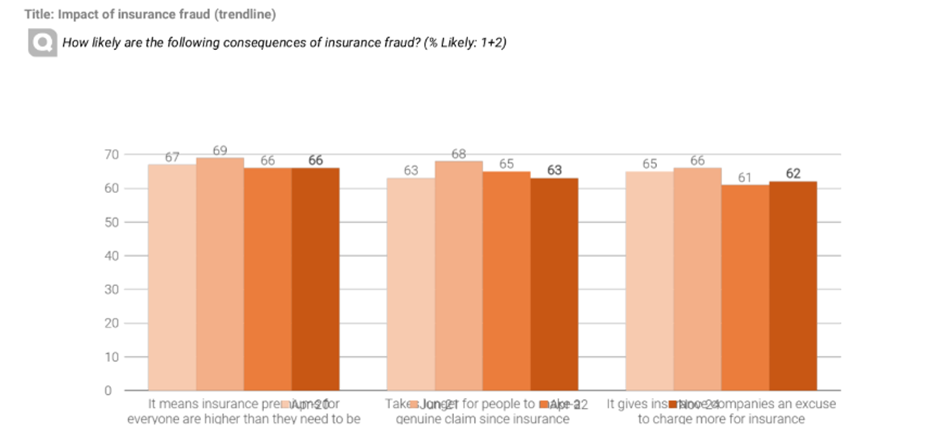

The trendline data shows that the perceived impact of insurance fraud on consumers has remained relatively stable over the past four years, with a slight decline from its peak in 2021. The most widely recognised consequence continues to be higher insurance premiums, with 66% of respondents believing fraud drives up costs for everyone, down slightly from 69% in 2021. Similarly, 63% acknowledge that fraud leads to longer claim processing times due to the need for thorough investigations, a small decrease from 68% in 2021. Additionally, 62% see fraud as giving insurance companies a reason to charge more, compared to 66% in 2021. While awareness remains high, the slight decline suggests that while Kiwis still recognise the financial strain caused by fraud, perceptions may be shifting. This underscores the ongoing need to educate consumers about the real-world impact of fraudulent claims and encourage proactive reporting to minimise these consequences.

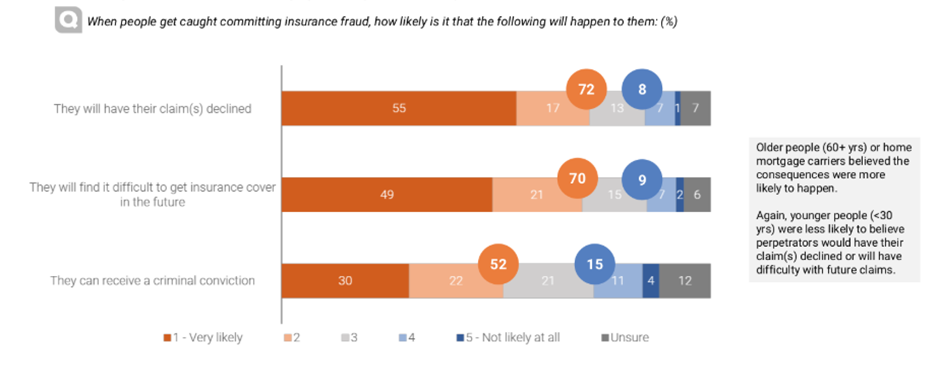

Next, respondents were asked when people get caught committing insurance fraud how likely is it that A. They will have their claim declined, B. They will find it difficult to get insurance cover in the future, or C. They will receive a criminal conviction.

Their answers showed that the most widely recognised penalty is claim denial, with 72% of respondents believing it is very likely that fraudulent claims will be rejected. Additionally, 70% think perpetrators will struggle to obtain insurance in the future, reinforcing the long-term impact of fraudulent activity. However, fewer people—just 52%—believe that insurance fraud could result in a criminal conviction, indicating a gap in awareness about the legal repercussions. Older respondents (60+ years) and mortgage holders were more likely to expect severe consequences, whereas younger people (<30 years) were less convinced that fraudsters would face difficulties with future claims. These findings highlight the need for greater public education on the serious legal risks of insurance fraud, reinforcing that it is not just an ethical breach but a crime with lasting financial and legal consequences.

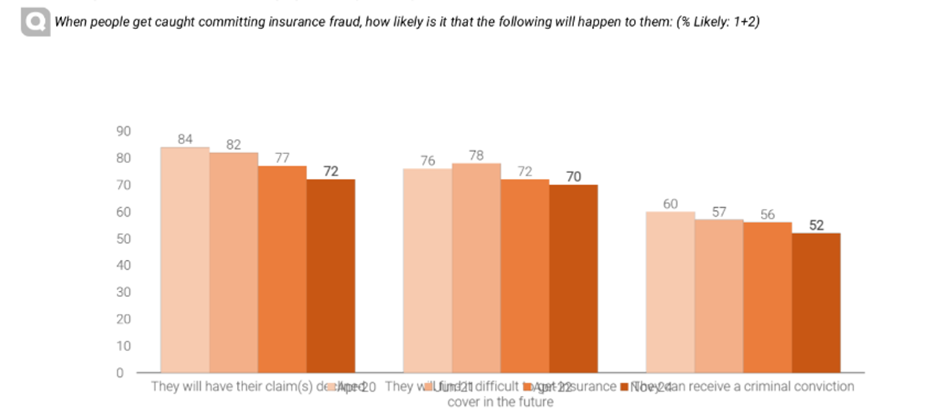

The survey trends over time show a gradual decline in the perceived consequences for perpetrators of insurance fraud since tracking began in 2020. While the most recognised penalty remains claim denial, belief in this consequence has dropped from 84% in 2020 to 72% in 2024. Similarly, the perception that fraudsters will struggle to obtain future insurance has declined from 78% to 70% over the same period. The most significant decrease is in awareness of potential criminal convictions, falling from 60% in 2020 to just 52% in 2024. Despite these declines, the most common consequences remain the same, indicating that while New Zealanders still recognise the risks of insurance fraud, awareness of its severity may be fading. This trend highlights the need for continued public education on the lasting financial and legal repercussions of fraudulent claims to deter would-be offenders and protect honest policyholders.

The findings from the November 2024 Fraud Survey paint a clear picture: insurance fraud continues to be a widespread concern in New Zealand, with exaggerated claims and misinformation being the most commonly perceived forms of fraud. While awareness of the financial burden fraud places on honest policyholders remains high, the declining recognition of legal consequences suggests a potential shift in public perception. As fraudulent claims contribute to higher premiums and longer processing times, it is crucial to reinforce education around the real-world impact of fraud—not just for consumers but for those tempted to commit it. Strengthening awareness, encouraging vigilance, and promoting reporting mechanisms are key steps in protecting the integrity of New Zealand’s insurance system. By working together to detect and deter fraud, we can help ensure a fairer and more sustainable insurance market for all. Believe you have seen fraud in action? You can report it anonymously now.