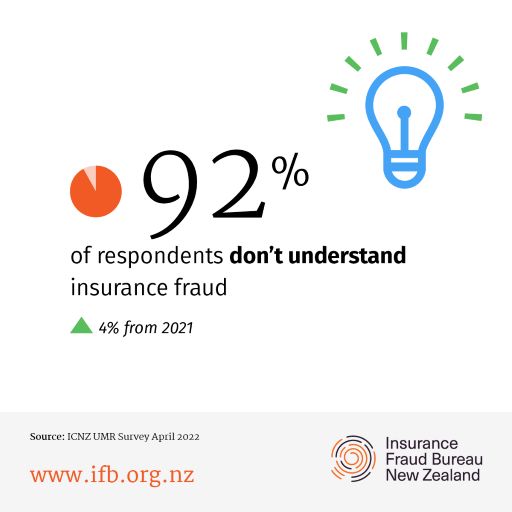

The Insurance Fraud Bureau (IFB) has recently completed its third annual research survey to understand how much New Zealanders understand about insurance fraud. Yet again, the results have demonstrated that a significant number of Kiwis still do not understand the personal implications of insurance fraud, and the impact and cost for all policyholders.

The IFB continues to educate the New Zealand public about insurance fraud via its website (www.ifb.org.nz/media/news) and Facebook page.

“With minimal or no change to many of our insurance fraud figures, we believe our focused education efforts are important in the fight against insurance fraud. More help and support is needed from insurers, the Police and others fighting to reduce insurance fraud in New Zealand and abroad,” commented Yvonne Wynyard, IFB Manager.

Exaggerating insurance claims and non-disclosure or misrepresenting information continue to be the most common forms of insurance fraud in New Zealand. Kiwis don’t understand however, that there can be serious implications for them if caught.

Being caught or suspected of committing insurance fraud can mean your ability to apply for common insurances such as car or house insurance in the future is at risk.

Of course, the cost of insurance fraud is borne by all insurance policyholders – making insurance policies more expensive for everyone.

Keen to understand more about our insurance fraud research? Check out our video summary here:

General insurers in New Zealand are certainly working together to reduce the impact of insurance fraud on their customers. These 2022 research survey insights help the IFB focus on education opportunities for Kiwis and continue their work in deterring and reporting fraudulent insurance activity.

Concerned about insurance fraud?

Insurance fraud is not a victimless crime; it’s a crime that all policyholders pay for.

It’s critical to tell the truth about what’s happened when making a claim. You can report insurance fraud anonymously on our website.